Perodua sales exceed 200,000 units in 2015; nearly 100,000 Axias sold

Berita KeretaPerodua’s position as Malaysia’s best-selling car maker continues for a tenth successive year, with a record 213,300 vehicles in total sold throughout 2015. This marks the first occasion which the company’s sales exceeded the 200,000-unit threshold, thus making 2015 Perodua’s best year to date.

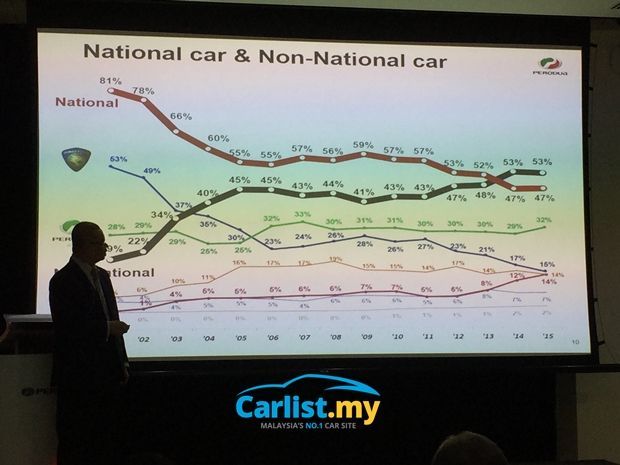

In spite of challenging market conditions caused by implementation of the Goods and Services Tax (GST), weakening of the Ringgit, and slump in crude oil prices, Perodua sales had remained robust; concurrent with its increased sales volume, the company also grew its market share from 29% in 2014 to 32% in 2015, based on Perodua’s internal estimates of the market’s total industry volume (TIV) at 667,000 units.

Perodua President & CEO, Datuk Aminar Rashid Salleh further suggested that the weak market had in fact worked in the company’s favour.

“Because of these challenges, many consumers have decided to ‘buy down’ to a more affordable alternative such as the Axia, which accounted for 99,700 units or 46.7% of Perodua’s entire sales for 2015,” he elaborated whilst speaking at Perodua’s annual media briefing held for the first time at the company’s new flagship 3S centre in Petaling Jaya.

Launched in September 2014, the Axia had a full year of sales for the first time in 2015, and demand for the pint-sized hatchback remains strong, with showrooms collecting an average of 10,000 – 11,000 bookings monthly. The new Perodua Global Manufacturing Sdn Bhd (PGMSB) is now working on two shifts per day just to keep up with demand.

At the briefing, Aminar also revealed that combined production of the Axia from the PGMSB plant as well as the Myvi and Alza from the original plant had hit 228,500 units, up 16.3% from 196,400 units produced in 2014.

Despite the considerable increase in sales volume, profitability was impacted by a combination of two factors. Firstly, the weakened ringgit resulted in cost increases for imported parts; secondly, many customers seeking to minimize spending have opted for lower variants in the model range that generate thinner margins.

Aminar pointed out that impact of the weakened ringgit would have been more severe if Perodua’s supply chain was not as extensively localized as it currently is. In 2015, Perodua spent RM4.9 billion purchasing parts from local vendors. The company’s present range of models utilizes 8-10% imported content.

For 2016, Perodua maintains a cautiously optimistic outlook, targeting a modest increase with a stated sales target of 216,000 units, maintaining a projected market share of 32% based on the company’s internal forecast of a 670,000-strong TIV.

Besides chasing numbers, Perodua also targets improvement in customer perception. Although internal surveys show positive results, the company aims to do better with its JD Power rankings, targeting to be among the top five brands in both sales satisfaction and customer satisfaction surveys.

Shopping for a Perodua? A vast assortment of new and used Perodua vehicles are available on Carlist.my!